Rollovers And Withholding Tax

When you change jobs, you usually are eligible to roll over your qualified plan balance to a traditional IRA or another employer-sponsored plan, assuming the amount is rollover eligible. If this is done as a direct rollover, no taxes will be withheld from the amount.

If you have the amount paid to you instead, 20% will be withheld for federal taxes, and you will have 60 days to roll over the amount. Further, if you intend to roll over the entire amount, you will need to make up the 20% withheld for taxes out of pocket.

To help simplify the process, speak to the human resources manager at your old employer to get any documents necessary to initiate the rollover, says founder and president of Index Fund Advisors, Inc., Irvine, Calif., and author of “Index Funds: The 12-Step Recovery Program for Active Investors.”

Have a plan in terms of where you want the assets to go,” Hebner adds. “If it is to your new employers 401 plan, speak with your current HR manager to make sure everything is lined up in order to receive the transfer. If it is to a rollover IRA, have the account already created to receive the assets. This will create a smooth transition for the rollover.

Rollover To An Annuity

A guaranteed lifetime income annuity, similar to a pension distribution, will provide a steady stream of income that’s guaranteed to last for the rest of your lifeno matter how long you live.1 With an annuity that offers a guaranteed payout, you wont have to worry about the impact a decline in the market will have on your payments.

This Rollover Is Taxable

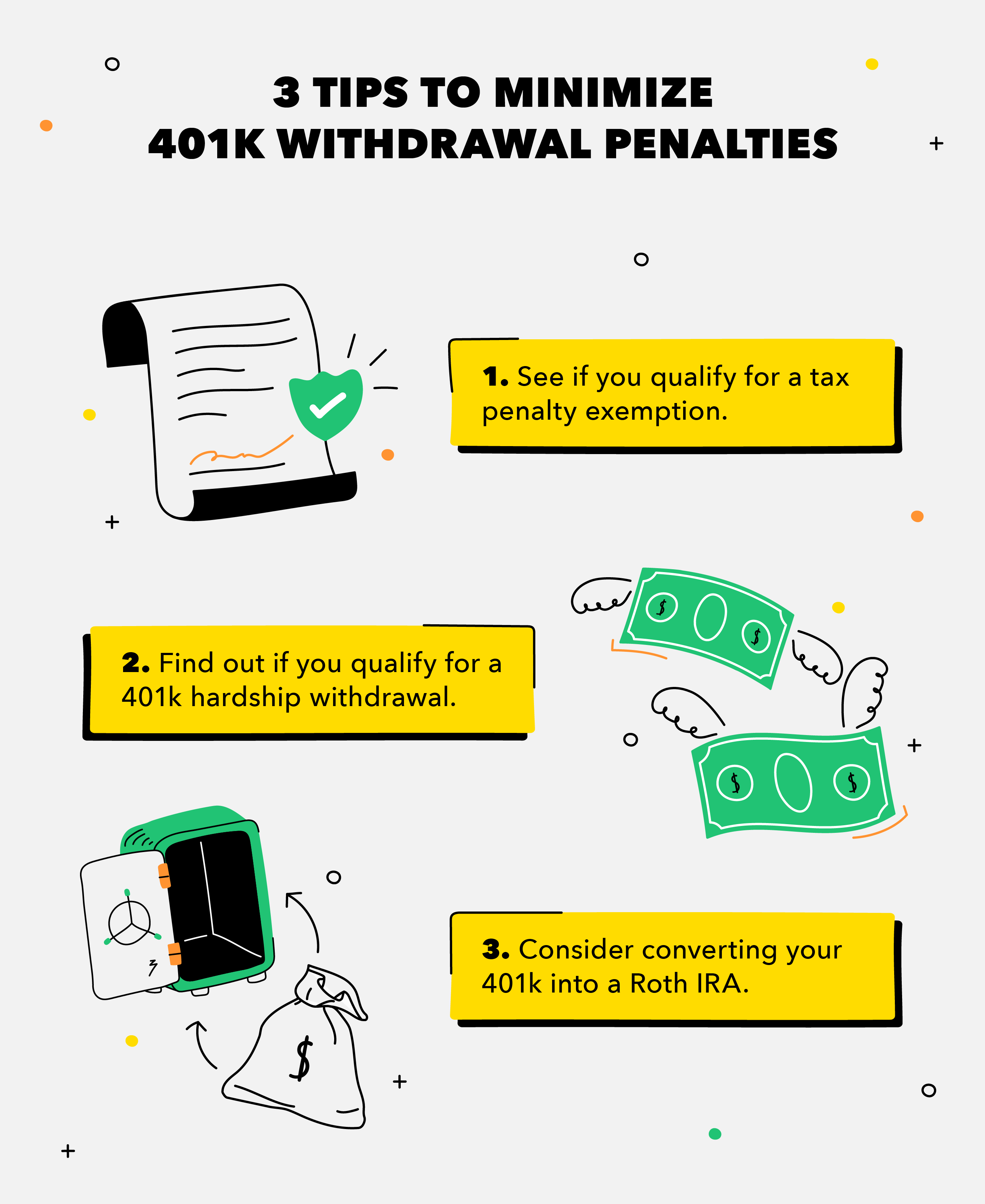

A 401 rollover to a Roth IRA changes the tax treatment of your money, which DOES cause a taxable event. Your 401 money is pre-tax, whereas Roth IRA contributions are post-tax, so this conversion will have you adding on the rollover money to your income taxes in the year in which you make the switch.

Chief Investment Adviser of Impact Advisors LLC and CFA Jason Escamilla cautions that you can only do this conversion once and that youll need to be aware of income limits to enjoy the full tax benefit.

If you were between jobs for a while or otherwise in a lower-income / lower tax bracket year, if you do not roll over to the current-company 401, you have the option to convert the old plan to a Roth IRA. But you lose this option once you roll over into another 401 plan.

For both options, the name of the game is consolidation. Having all of your 401 assets in one place simply makes sense, but it also means youre not paying fees to 5 different institutions. Whether or not you want to be actively investing in these accounts is up to you, but its important to make sure youre with an institution and advisor you feel comfortable speaking with about your retirement investments.

You May Like: How To Rollover 401k To Ira Fidelity

Tiaa To Fidelity And/or Vanguard

Transfer funds from TIAA fund into a Fidelity and/or Vanguard fund

Recommended Reading: How To Get Money From Your 401k

Should You Rollover A 401 Or 403

Rolling over your 401 or 403 to a low-fee IRA is a smart financial decision for most millennials.

You can get both low fees and a lot of variety.

Reasons people do nothing can range from my current 401 is performing well to I want to look at the returns before I make a decision.

If you decide now to roll over your 401 every time you switch jobs, you wont have to make this decision each time you change employers.

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover ChartPDF summarizes allowable rollover transactions.

Also Check: Can You Take Money From Your 401k

Recommended Reading: Can I Move My 401k From One Company To Another

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Reasons To Avoid A 401 Rollover

There are some cases when it doesnt make sense to roll your 401 into another account:

IRAs are less protected. If you end up declaring bankruptcy later, a 401 offers more protection from creditors than an IRA.

Higher fees. Depending on the situation you could end up with higher fees when you roll an old 401 into a new 401. Check the fees associated with the new account before you move your money.

Limited investment choices. A new employers 401 might have more limited investment choices. If thats the case, you might want to stick with your existing 401 because the assets work better for your situation.

A 401 gives you access to the rule of 55. With a 401, you might be able to begin taking withdrawals from your account penalty-free before age 59 ½ if you leave your employer after age 55. While IRAs dont have this feature, you may be able to emulate it by taking subsequently equal periodic payments from your IRA.

Don’t Miss: Can I Invest My Own 401k

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement-related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or, if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash-out at age 24 leads to $23,000 less in your projected account balance at age 67 a total of 5 percent. Even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Should I Transfer My 401 To My New Job

In most cases, transferring your 401 to a new job makes sense. Its typically better to have your 401 funds in one place if the variables align properly plan at your new job, and youd like easier control over the funds).

But this is not to say there arent many instances where youd be better off leaving it as is or even looking into an IRA rollover. The only one that can truly determine if you should roll over your 401 is you if youre having trouble making a decision, you can consult with a fee-only financial planner to discuss your particular situation.

Regardless if you decide to transfer your 401 to a new job, take time to understand the pros, cons, and potential tax consequences of any decision you make surrounding your old 401.

Recommended Reading: How To Start My Own 401k

Roll Over Traditional Money Into The Tsp

A rollover is when you receive eligible money directly from your traditional IRA or plan and then you later put it into your TSP account. You cannot roll over Roth money into the TSP and you must complete your rollover within 60 days from the date you receive your funds. Use Form TSP-60, Request for a Transfer Into the TSP, to roll over eligible traditional money.

Decide What Kind Of Account You Want

Your first decision is what kind of account youre rolling over your money to, and that decision depends a lot on the options available to you and whether you want to invest yourself.

When youre thinking about a rollover, you have two big options: move it to your current 401 or move it into an IRA. As youre trying to decide, ask yourself the following questions:

- Do you want to invest the money yourself or would you rather have someone do it for you? If you want to do it yourself, an IRA may be a good option. But even if you want someone to do it for you, you may want to check out an IRA at a robo-advisor, which can design a portfolio for your needs. But do-it-for-me investors may also prefer to make a rollover into your current employers 401 plan.

- Does your old 401 have low-cost investment options with potentially attractive returns, and does your current 401 offer similar or better options? If youre thinking about a rollover to your current 401 plan, youll want to ensure its a better fit than your old plan. If its not, then a rollover into an IRA could make a lot of sense, since youll be able to invest in anything that trades in the market. Otherwise, maybe it makes sense to keep your old 401.

- Does your current 401 plan offer access to financial planners to help you invest? If so, it could make sense to roll your old 401 into your new 401. If you move money to an IRA, youll have to manage it completely and pick investments or hire someone to do so.

Don’t Miss: How To Opt Out Of Fidelity 401k

You Dont Have To Leave Your 401 Behind When Changing Jobs

Employers offer 401 plans, with their tax advantages, as a benefit to attract and retain talent. Increasingly, however, Americans with 401s are not working with one company for their entire career. Today, people generally stay at a company for about 4.1 years, according to the U.S. Bureau of Labor Statistics.

Employees who change jobs can roll over their 401 from their previous employer to their new employer with a direct trustee-to-trustee transfer. But they must make the rollover within 60 days and abide by other rules for this process. This strategy has advantages and potential downsides to consider.

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. IRAs typically offer a much wider array of investment options than 401s, unless you work for a company with a very high-quality planusually the big, Fortune 500 firms.

Some 401 plans only have a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the companys stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. IRA fees tend to run cheaper depending on which custodian and which investments you choose.

With a small handful of exceptions, IRAs allow virtually any asset, including:

If youre willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

You May Like: How To Transfer Roth 401k To Roth Ira

What To Do With Your 401 When You Leave Your Job

When you leave a job or retire, you may wonder what to do with your 401. And while some things about change can be complicated, figuring out what to do with your 401 account doesnt have to be.

In general, there are four primary options for someone who already has a 401 plan through an employer. Lets take a look at each:

1) Stay in your current plan

Staying in your current 401 plan is sometimes the easiest choice. If you like the features and services of your plan and want to maintain your current investments, then staying put may be the best option for you. Generally, you can leave your money in your plan and retain its tax-deferred status. .

Considerations: Some plans have mandatory distributions for accounts with a balance of less than $5,000. You should check with your employers plan administrator to see if they require mandatory distributions.

2) Open an Individual Retirement Account

Another option is to roll over your funds to an IRA. If you want more investment options than your current plan offers, want to control your investments, or have multiple retirement accounts and want to consolidate your money, this may be the best option for you. Also, by moving your money to an IRA, it remains in tax-deferred status. And if youre in a lower tax bracket at retirement, you may pay fewer taxes then, too.Considerations: IRAs have different investment options, costs and advice offerings. Its important to choose one that fits your preferences .

4) Cash out

Rollover To A Life Insurance Policy

Technically, you cant roll over your 401 account into an insurance policy however, if you have a life insurance needs, you can withdraw funds from the account and redirect them to pay for a life insurance policy. You can avoid early withdrawal penalties under IRS Rule 72t,2 which allows you to take equal payments from your accounts. However, you must agree to take consistent withdrawals from your account each year for life.

You May Like: Can You Contribute To 401k And Ira

You Can Still Roll Over A Loan Offset From A 401

Although you cant roll over an unpaid loan balance to another 401 or IRA and continue to make regular payments on it, you can avoid taxation on the loan offset that results when you take a distribution without repaying your outstanding loan balance.

When your prior employer offsets the outstanding loan balance you owe, you will be required to take this outstanding amount as taxable income for the year. But, if youre able to open an IRA , you can indirectly rollover the amount of the loan offset to your account, by depositing the outstanding loan amount in cash to your IRA account as an indirect rollover. If you do this within the 60 day period following your loan offset, your outstanding loan amount will not be taxable to you at year end. If you qualify for a QPLOs, youll have a longer period of time to make a contribution to an IRA.

To help avoid any issues, we think its best to pay off an outstanding loan before requesting a termination distribution, if you are able. If you do this, you can rollover the entire balance to a 401 plan or IRA without involving the indirect rollover process.

What Is The Earliest A Federal Employee Can Retire

Generally, an employee is eligible for retirement or an employee with at least 30 years of service and 55 years under the Civil Service Retirement System or 56 months in 2022 under Federal Employees Retirement

What is the best month for a federal employee to retire?

The best time of year for employees closed by FERS to leave a job closer or better at the end of the year of resignation. Generally, this time in late December to early January anytime between December 31 and January 13, incl.

What is the earliest I can retire under FERS?

MRAs range in age from 55 to 57 years, depending on your age. The same goes for retirement under VERA, but only if you reach your MRA. The SRS will remain 62 years old, once you qualify for Social Security benefits.

Dont Miss: How Does 401k Work When You Quit

Read Also: How To Use Your 401k To Buy A Business

Make The Best Decision Based On Your Needs

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary, so its essential to find out the rules your former employer has and the rules at your new employer.

Do also compare the fees and expenses associated with the accounts youre considering. If you find it confusing or overwhelming, contact us and we can help answer questions you may have about the rollover process.

Advisory services provided by Slavic Mutual Funds Management Corporation, an SEC-registered investment adviser. Registration does not imply a certain level of skill or training on the part of SMF or its representatives. Administration and record-keeping services are offered through Slavic Integrated Administration. Both entities are collectively referred to as Slavic401k.

For more details on Slavic Mutual Funds Management Corporation, see our About Us page. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Neither diversification nor asset allocation ensure a profit or guarantee against a loss.