Contributions And Market Volatility

During a market downturn, its important to take a step back, and recognize that when saving in your 401, you are investing for the long-term. Even though you might be afraid of investing in a volatile market, we believe its a good idea to continue to contribute to your 401.

Putting money into your 401 each pay period is a natural way to dollar cost average, which is a strategy where you invest a fixed dollar amount of money at regular intervals, over a long period of time. This means you wont invest all your money into the market when it is either at a low or a high.

Of course, when the market stumbles, it can mean the economy isnt doing well, so its important to reassess the personal impact on your budget and expenses too. You should take a look at your whole financial picture to strategize how you can continue to save, and continue your regular 401 contributions to smooth out your returns over time.

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Deferral Limits For 401 Plans

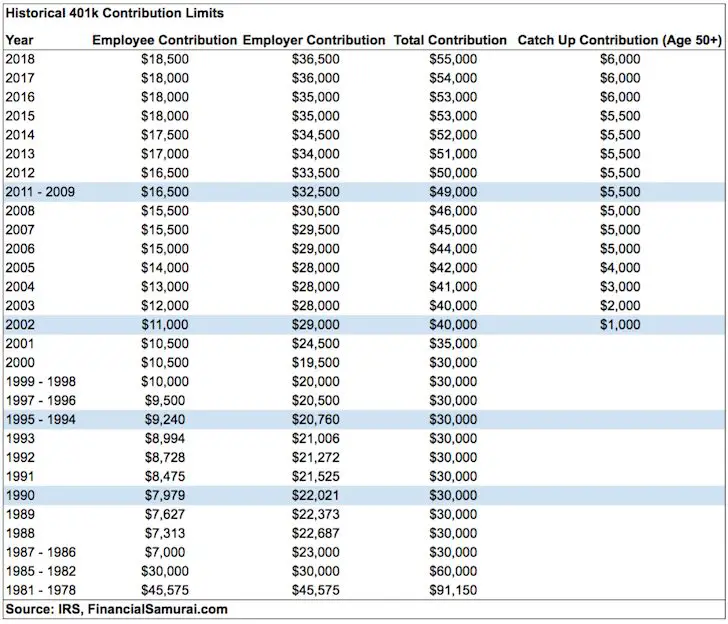

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

You May Like: How To Transfer A 401k To Another 401 K

What Is The Highest Amount You Can Contribute To 401k

For 2021, your 401 contribution limit is $19,500, or $26,000 if youre 50 or older. In 2022, the 401 contribution limit for individuals is $20,500, or $27,000 if youre 50 or older.

What is the max 401k contribution for 2021?

WASHINGTON â The IRS announced today that the amount individuals can contribute to their 401 plans has increased to $20,500 in 2022, up from $19,500 for 2021 and 2020.

What is the most you can contribute to a 401k annually?

The contribution limit for employees participating in 401, 403, most 457 plans and the Federal Savings Plan has been increased from $19,000 to $19,500. The compensation contribution limit for employees age 50 and older participating in these plans has been increased from $6,000 to $6,500.

Open Simultaneous Retirement Funds

The IRS allows you to contribute to a 401, an IRA and a Roth IRA in the same year. However, there is overlap between the contribution limits for an IRA and a Roth IRA.

If you are already maximizing your contribution limits to your 401 but are still concerned that it isnt enough, consider opening an IRA or a Roth IRA to supplement your savings. Doing so will allow you to put money into multiple retirement accounts at the same time, helping you to boost your savings considerably.

If you already have simultaneous retirement accounts, consider simply opening an earmarked account. Even though it wont see the same tax advantages, theres no reason that you cant save for retirement with an ordinary investment portfolio. You can put as much money into it as you like then just plan on leaving it there for retirement.

Also Check: How To Fill Out A 401k Withdrawal Form

Two Annual Limits Apply To Contributions:

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Recommended Reading: How To Cash In My 401k Early

Do Not Dip Into Your Funds Early

Peter Ferriello, CFP, Senior Wealth Advisor, and VP at Mollot & Hardy, Inc. Wealth Advisors

At a minimum, people should contribute an amount equal to their employer match. Many workers miss out on free money that their employer is willing to contribute to their account. This is a critical mistake that has a lasting impact on ones future. In order to calculate how much you should actually contribute beyond the match, it’s recommended you sit with a financial planning professional, preferably a CFP, who can help you calculate the amount that is necessary, but also realistic.

It’s also important to stress that taking loans and withdrawals from one’s 401k can have detrimental consequences on the future value of the account.

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Also Check: Can You Buy A House With 401k

How Much Can You Put In A 401

The IRS sets contribution limits for elective deferral contributions every year. For the years 2020 and 2021, the elective deferral for workers who contribute to a 401 or 403 is $19,500. The limit for 2019 was $19,000. This contribution limit applies to workers who are below age 50.

If you are above 50, the IRS allows catch-up contributions to help you compensate for the years you did not contribute to a 401 plan. For 2020 and 2021, IRS allows catch-up contributions of $6,500. Including the employer’s match, the amount of annual 401 contributions cannot exceed $58,000 in 2021 or $57,000 in 2020.

Which Account Is Right For You

Traditional 401

- Taxes: You make pre-tax contributions and pay tax on withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are added directly to your 401 account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72

- Heirs are subject to RMDs and taxed on distributions

Roth 401

- Taxes: You make after-tax contributions and don’t pay tax on qualified withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are deposited into a separate tax-deferred account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72 however, you could roll over funds to a Roth IRA to avoid RMDs

- Heirs are subject to RMDs but not taxed on distributions

Now that you have a better understanding of a Roth 401, you might be wondering how it differs from a Roth IRA. Contributions to either account type are made with after-tax dollars, and you won’t pay taxes on qualified distributions. The differences between the two types of Roth accounts come down to contribution limits, income limits, and RMDs.

Read Also: Can You Roll A Traditional 401k Into A Roth Ira

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

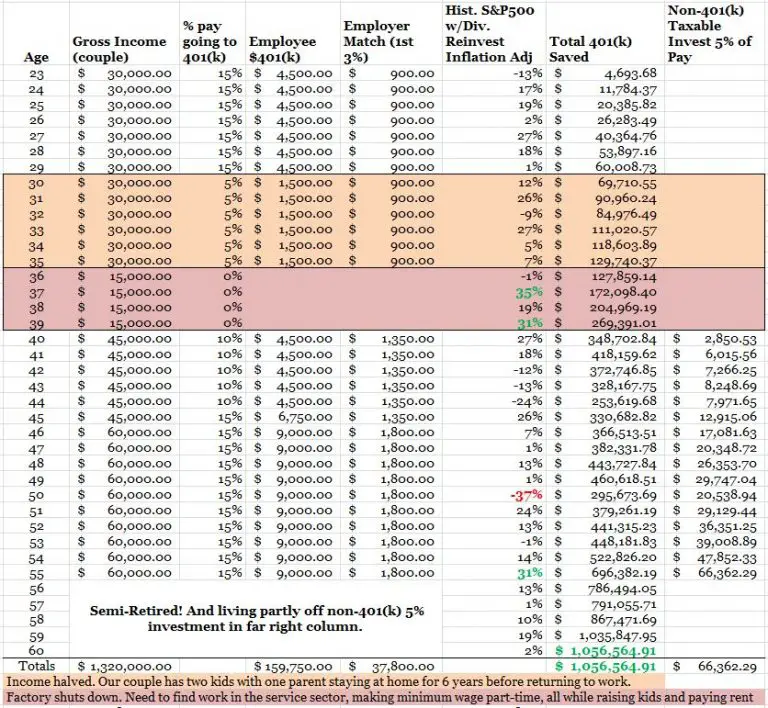

Max Out Your 401 During A Recession

Although your 401 alone will unlikely be sufficient to meet all your retirement expenses, if you max out your 401 every year, you will likely far surpass the median and average household retirement savings held by those between the ages of 56 61 today.

In fact, it is likely you will retire a 401 millionaire by the time you are able to withdraw from your 401 penalty-free at age 59.5. Check out the chart below that shows mow many years it will take for you to become a 401 millionaire based on historical returns and portfolio allocations.

In fact, I expect everyone to become 401 millionaires by the age of 60 if they keep maxing out their 401 every year for 30+ years. The power of compounding over time cannot be denied.

Related: Should I Make After-Tax Contributions To My 401?

Also Check: How To Transfer 401k After Leaving Job

Diversify Plans If Possible

Matthew Yu, Loan Originator for Socotra Capital

Some employers have small matches, but some match dollar for dollar on your first 3-5 percent. Thats 100 percent ROI at the end of each year for your 3-5 percent contribution!

For those with less generous employee matches and limited investment funds, you should carefully gauge your companys 401 plan to see if you could get better returns investing in a Self-Directed IRA. The amount you put into the 401 is just as important as the type of investment that your 401 is invested in.

For best diversification, I would recommend those new to the workforce to split up their retirement savings into their 401 and Roth IRAs. Set aside an investment budget that stings, but isnt too painful. Your 401 will be automatically withdrawn every month. Money that doesnt hit your pocket is much easier to invest than the money that comes out of it. Investing early pays dividends.

Can I Retire At 62 With $400000 In 401k

Shawn Plummer

CEO, The Annuity Expert

When it comes to retirement planning, there are a lot of factors to consider. How much money do you need to retire? What will your monthly expenses be in retirement? How long will you live? These are all important questions that you need to answer if you want to have a successful retirement. In this guide, we will explore the question of whether or not you can retire at 62 with $400,000 saved in your 401k. We will also offer some retirement planning advice for those who are looking to retire as soon as possible!

Don’t Miss: Can I Withdraw 401k After Leaving Job

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

How Much Should A 35 Year Old Invest In 401k

So, to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. It’s an attainable goal for someone who starts saving at age 25. For example, a 35-year-old earning $60,000 would be on track if she’s saved about $60,000 to $90,000.

Recommended Reading: What Happens To 401k When You Leave Company

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

You May Like: What Happens To My Roth 401k When I Quit

How Much Should You Contribute

Ideally, you’d take advantage of the IRS maximum contribution limit to your account year after year. But if that’s not possible financially, start by contributing enough to max out your employer contribution. If you’re not sure what that is, check with your company’s benefits administrator. They can walk you through the matching contribution policy and direct you on how to set up contributions.

“Contribute the maximum your household budget will allow, up to the maximum annual contributions allowed by the IRS,” says Daniel Milan, managing partner at Cornerstone Financial Services. “At the very least, if your company offers a match, you should contribute at least the percentage required to get the maximum match, as that is free money you’re leaving on the table if you don’t.”

Pay attention, though. Your company may change its matching policy from time to time, so make sure to check in annually with your plan administrator. You’ll want to take full advantage of any employer contributions as long as it’s financially possible.

What Is A Backdoor Roth

A backdoor Roth IRA lets you convert a traditional IRA to a Roth, even if your income is too high for a Roth IRA. … Basically, a backdoor Roth IRA boils down to some fancy administrative work: You put money in a traditional IRA, convert your contributed funds into a Roth IRA, pay some taxes and you’re done.

Read Also: How To Find Out Who Your 401k Is With

Be Sure To Layout A Retirement Budget

Deacon Hayes, Owner & Founder of WellKeptWallet

Everyone’s life and circumstances are unique. Therefore, what works for one person is not going to be a magic formula that works for all. That being said, it’s always better to save more than you need rather than less.

Start by determining the age you would like to retire. Then, create a post-retirement budget to help you determine how much money you will need to save up ahead of time. Don’t forget to include vehicles, insurance, taxes, and other expenses that are not always monthly.

You can use a 401 calculator to assist you in determining how much money you should be investing at any age. However, here is a general guideline :

- At age 30 a minimum of one year’s salary

- At age 35 at least two years salary

- At age 40 three years salary or more

- At age 45 four years salary at minimum

- At age 50 at least five years salary

- At age 55 six years salary if not more

- At age 60 seven times your annual salary

- At age 65 at least eight times your yearly salary

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Also Check: What Should I Do With 401k

Don’t Miss: Can I Use My 401k To Invest In Real Estate